Introduction:

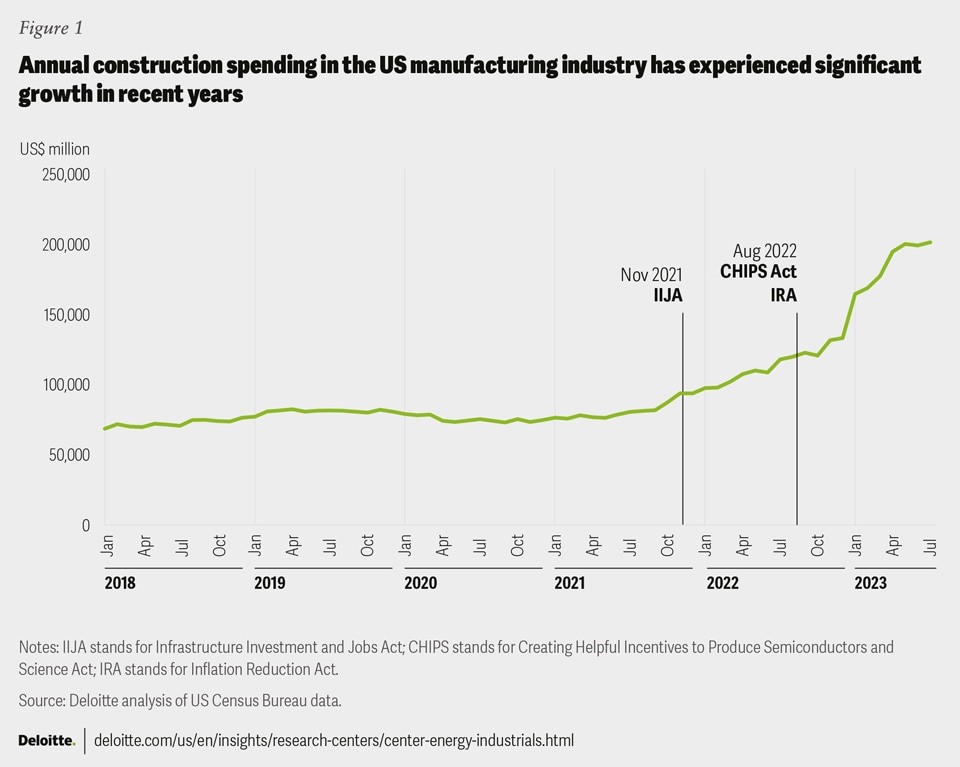

In the dynamic landscape of the US manufacturing industry, 2023 witnessed unprecedented growth driven by key legislations like the Infrastructure Investment and Jobs Act (IIJA), the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, and the Inflation Reduction Act (IRA). These legislations focused on rebuilding infrastructure, promoting clean energy initiatives, and bolstering the domestic semiconductor industry. As a result, the manufacturing sector experienced a surge in private sector investments, particularly in semiconductors, clean technology, electric vehicles, and batteries.

Infrastructure and Clean Technology Investment:

The IIJA, CHIPS, and IRA have spurred substantial private sector investment, with semiconductor and clean technology manufacturing seeing nearly double the commitments made in 2021 and almost 20 times the allocation in 2019. Over $88 billion has been invested in close to 200 new clean technology manufacturing facilities, generating over 75,000 new jobs. The impact is evident in the construction sector, with manufacturing construction spending reaching $201 billion as of July 2023, marking a significant 70% year-over-year increase.

Challenges in 2024:

Despite these positive strides, the manufacturing industry faces challenges in 2024. Economic uncertainty, a persistent shortage of skilled labour, targeted supply chain disruptions, and the need for innovation to achieve net-zero emissions goals present hurdles. Deloitte's analysis of Purchasing Managers' Index (PMI) data reveals a contraction in the manufacturing sector for most of 2023.

Digital Transformation as a Catalyst:

To tackle these challenges, manufacturers are turning to technology for support. Digital transformation initiatives are underway, with a focus on efficiency, resilience, and innovation. Smart factories, the industrial metaverse, and generative AI are emerging as crucial tools to add value to manufacturing operations.

Smart Factory Solutions and Industrial Metaverse:

A recent Deloitte study indicates that 86% of surveyed manufacturing executives believe smart factory solutions will be the primary drivers of competitiveness in the next five years. The industrial metaverse is also gaining traction, with manufacturers anticipating a 12% gain in labour productivity. Generative AI is expected to revolutionize areas such as product design, aftermarket services, and supply chain management, offering cost reductions and a solution for navigating the challenging labour market.

Addressing Persistent Talent Obstacles:

The tight labour market continues to pose challenges for manufacturers in 2024. The National Association of Manufacturers (NAM) survey reveals that attracting and retaining a quality workforce is a primary business challenge for three-quarters of manufacturing executives. Proactive workforce policies, including flexible scheduling and workforce rewards, have been implemented. However, additional strategies are recommended for 2024, such as leveraging digital tools for talent acquisition, tapping into the knowledge of retirees through alumni programs, and building and upskilling the talent pipeline through collaborations with educational programs.

Smart Factory and the Industrial Metaverse:

As economic uncertainty, labour market challenges, and rising costs persist, the manufacturing industry is fully embracing the smart factory transition. This integration of AI, 5G, IoT, data analytics, and cloud computing offers real-time insights, end-to-end visibility, and scalable solutions. Manufacturers are also laying the foundation for the industrial metaverse, with 70% already incorporating technologies like data analytics and cloud computing. The industrial metaverse provides immersive 3D environments, fostering global collaboration and unlocking efficiencies across functions.

Cybersecurity in Focus:

While digital transformation brings significant benefits, it also introduces cybersecurity risks. Manufacturing companies need to prioritize cybersecurity to mitigate the risk of cyber threats. A study reveals that over half of surveyed manufacturing companies were targeted by ransomware, emphasizing the need for a balanced focus on potential benefits and cybersecurity when implementing new digital technologies.

Supply Chain Digitalization:

The manufacturing industry, still recovering from supply chain challenges post-COVID-19, is turning to digital solutions for enhanced transparency and resilience. 76% of manufacturers are adopting digital tools to gain better visibility into their supply chain. The industrial metaverse is also making inroads into supply chain resilience, with 21% of respondents integrating metaverse technologies. Technologies like distributed ledgers and smart contracts are gaining interest, with 25% of manufacturers planning to implement them in the next year.

Aftermarket Services as a Differentiator:

Manufacturers are increasingly recognizing the importance of aftermarket services as a revenue source, customer loyalty builder, and competitive advantage. Digital technologies such as IoT sensors, AR interfaces, and virtual reality are transforming aftermarket services. Enhanced offerings, including remote troubleshooting assistance and virtual operation manuals, are gaining popularity, providing revenue-generating opportunities, improved customer loyalty, and competitive differentiation.

Product Electrification and Decarbonization:

Federal funds and incentives, coupled with a commitment to a net-zero emissions future, are driving investments in electrification and decarbonization. Over $270 billion in climate- and clean energy-related incentives, including tax credits, have been allocated. However, challenges include technical readiness, high initial costs, and complex supply chains for batteries. Manufacturers are adopting strategies like collaborating for decarbonization, embracing net-zero emissions, creating specialized verticals, and strategically expanding into adjacent markets.

Conclusion:

As the US manufacturing industry navigates through 2024, continued growth is expected. Embracing digital transformation, technology adoption, and innovative strategies will be crucial for manufacturers to address challenges and capture emerging opportunities. Strategies include improving talent attraction and retention, leveraging smart factories and the industrial metaverse, enhancing supply chain visibility, expanding aftermarket services, experimenting with generative AI, and accelerating the transition to zero-emission product portfolios. By staying agile and innovative, the manufacturing sector is well-positioned for sustained growth in the face of evolving challenges.

- Harvind Viswanath (CrispIdea Analyst)

For more on Manufacturing Industry CLICK HERE