Introduction:

Fintech has revolutionized the way we manage money, conduct transactions, and interact with financial services. This dynamic field combines cutting-edge technology with traditional financial services to enhance efficiency, accessibility, and innovation.

"Will India emerge as a 'global fintech powerhouse' despite the recent downturn in fintech funding?"

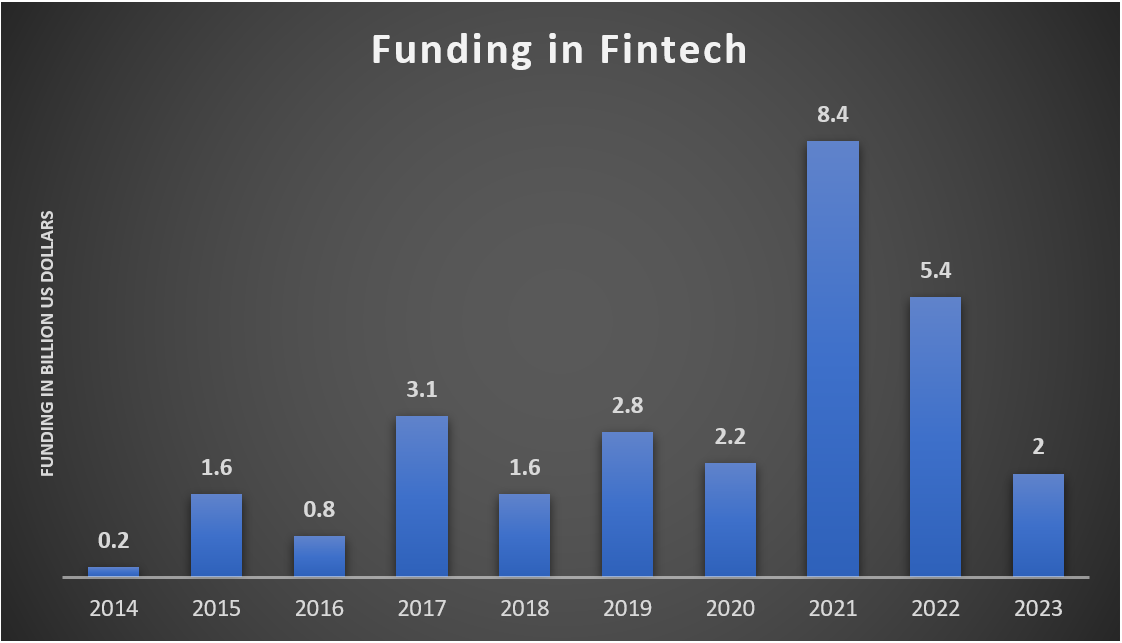

India's FinTech sector experienced a significant downturn in 2023, added with Regulatory actions have pushed investors, founders and even product managers to start thinking differently, with funding dropping to $2 billion, marking a decline of approximately 63% and 73% compared to the previous year’s figure of $5.4 billion in 2022 and $8.4 billion in 2021.

Venture investment in financial services which was top sector for startup funding globally stands at $43bn its lowest level in six years, according to Crunchbase data. That’s down more than 50% year over year from the $89.5 billion invested in financial services in 2022, and even more dramatically from the $143 billion invested in the sector in the peak market of 2021.

However, India ranked third globally in FinTech startup funding in the previous year, boasting approximately 10,244 FinTech entities, including 17 unicorns. This also places India as the third-largest FinTech ecosystem worldwide, with the United States and the United Kingdom holding the top two positions, each with significantly higher numbers of unicorns at 134 and 27, respectively, in 2023.

The Union Finance Minister of India noted that India’s Fintech ecosystem is the 3rd largest in the world and growing at 14% CAGR on 26-Feb-2024 in interaction with start-up and fintech entity.

India's digital infrastructure is a cornerstone in the expansion of fintech startups, facilitated by the widespread adoption of smartphones for digital transactions by over 300 million people. Additionally, the country sees billions of Aadhaar e-KYC transactions monthly and processes over 2 million account aggregator consent requests each month, showcasing the robustness and scale of its digital ecosystem.

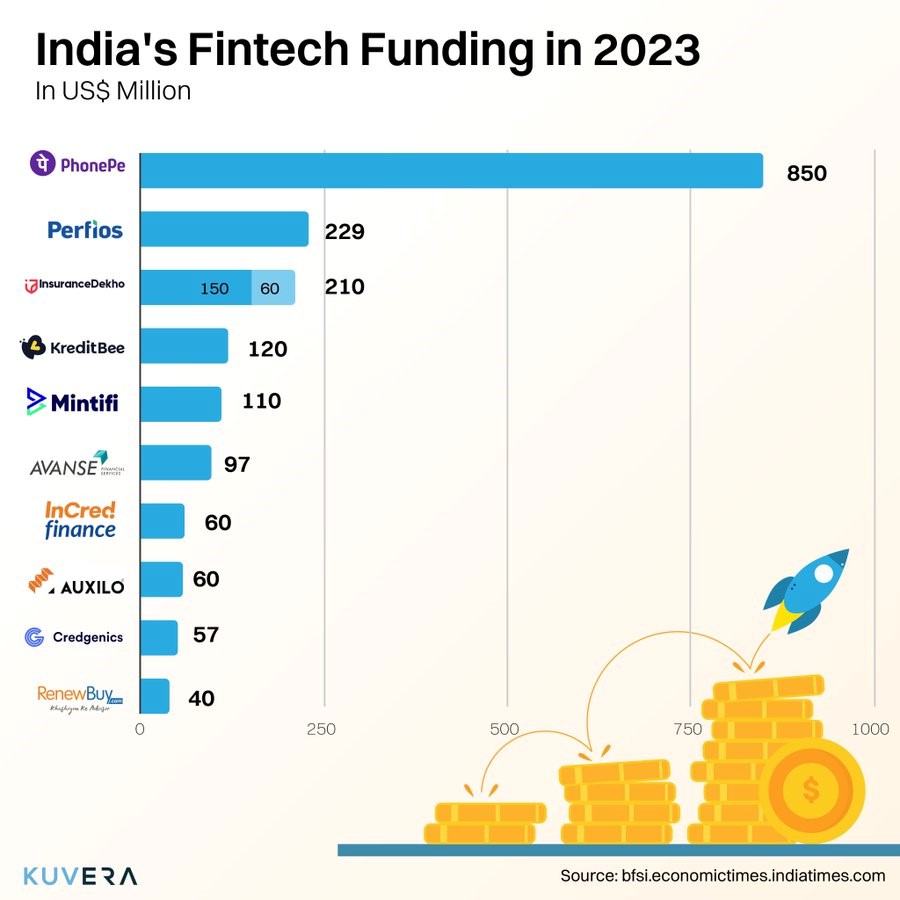

In 2023, only five fintech companies recorded funding rounds exceeding $100 million. PhonePe secured the largest round at $850 million, followed by Perfios with $229 million and InsuranceDekho with $210 million. KreditBee and Mintifi also received notable funding during the period.

FinTech faces a dual challenge of addressing historical issues while navigating complex regulations. Striking a balance between innovation and compliance is like walking a tightrope, as regulations can be unclear and difficult to interpret.

The incident involving Paytm Payments Bank served as a wake-up call for the fintech industry, highlighting regulatory concerns. The synchronized actions of market regulator SEBI and banking regulator RBI underscored a consumer-friendly approach, implementing strict regulatory measures to protect consumer interests. This development has prompted investors and founders to reassess their strategies and compliance with regulations.

The fast-growing fintech industry, along with other emerging digital sectors, has encountered increased regulatory scrutiny. Despite this, the government maintains a supportive stance towards the startup ecosystem, striving for a balanced approach to regulation that encourages innovation while ensuring a conducive regulatory environment.

As of 2024, the global fintech industry is valued at around USD 312.92 billion. Forecasts predict significant growth in the sector, with an estimated value of USD 608.35 billion by 2029, representing a compound annual growth rate (CAGR) exceeding 14% between 2024 and 2029.

1. United States

The US remains a Fintech powerhouse, home to Silicon Valley giants, disruptive startups, and innovative regulatory frameworks. Companies like Square, Stripe, and Robinhood have transformed the financial landscape.

2. China

China’s Fintech ecosystem is unparalleled. Alibaba’s Ant Group, Tencent’s WeChat Pay, and JD Digits dominate digital payments, lending, and wealth management. The Chinese market exemplifies rapid adoption and scale.

3. Europe

European Fintech hubs include London, Berlin, and Stockholm. Revolut, TransferWise (now Wise), and N26 lead the charge, offering borderless banking, remittances, and currency exchange.

4. Asia and Beyond

Japan, Singapore, and India are witnessing Fintech innovation. Neobanks, peer-to-peer lending, and blockchain projects thrive across Asia. Africa and Latin America also embrace Fintech to enhance financial inclusion.

Digital Payments : Fintech companies have revolutionized payment methods, offering convenience, security, and speed through digital payment solutions like contactless cards and mobile wallets, UPI, mobile banking, internet banking etc, transforming the way transactions are conducted.

Robo-Advisors: Automated investment platforms, known as robo-advisors like Zerodha, Upstox, Groww etc. utilize algorithms to manage portfolios and offer personalized investment advice. These platforms provide cost-effective solutions compared to traditional financial advisors, making investment management more accessible to a wider audience.

Blockchain: Blockchain technology revolutionizes fintech by offering secure, transparent, and decentralized transaction mechanisms. It enables faster cross-border payments, peer-to-peer lending, trade finance, and identity verification, while reducing fraud and improving regulatory compliance. Its impact promises to reshape the future of financial services.

Regtech: Regulatory technology, or RegTech, aids financial institutions in meeting regulatory requirements by automating compliance tasks, mitigating risks, and ensuring transparency. This technology streamlines regulatory processes, enhancing efficiency and adherence to compliance standards within the financial sector.

Open Banking: Facilitating secure data sharing among financial institutions which has fostered innovation by enabling the development of new products and services. This practice also promotes competition within the industry, driving advancements and improvements in financial offerings and customer experiences.

Despite the recent downturn in fintech funding in India, the country's fintech ecosystem remains robust and full of potential. With a significant number of fintech entities and a supportive government stance toward innovation, India has the foundation to emerge as a global fintech powerhouse. However, navigating regulatory challenges and striking a balance between innovation and compliance will be crucial for the continued growth and success of the fintech sector in India. Clear regulatory guidelines, transparency, and maintaining global competitiveness will be essential factors in shaping the future trajectory of India's fintech landscape. As the global fintech industry continues to evolve and expand, India stands poised to play a significant role in driving innovation and reshaping the future of financial services.

- sukshith shetty (Equity Analyst)

For more on Fintech CLICK HERE

Subscribe for the Latest Equity Company CLICK HERE