The semiconductor industry is a vital cog in the global economy, underpinning a vast array of products and technologies that permeate our daily lives, from computers and smartphones to automobiles and medical devices. However, the industry has encountered its fair share of tribulations in recent years, including the disruptive impact of the COVID-19 pandemic, supply chain hiccups, and the lingering trade tensions between the United States and China. These trials have given rise to a worldwide semiconductor shortage, casting ripples across an array of sectors.

As we set our sights on 2024, the semiconductor industry grapples with these adversities while simultaneously witnessing the dawning of several promising trends that could usher in growth.

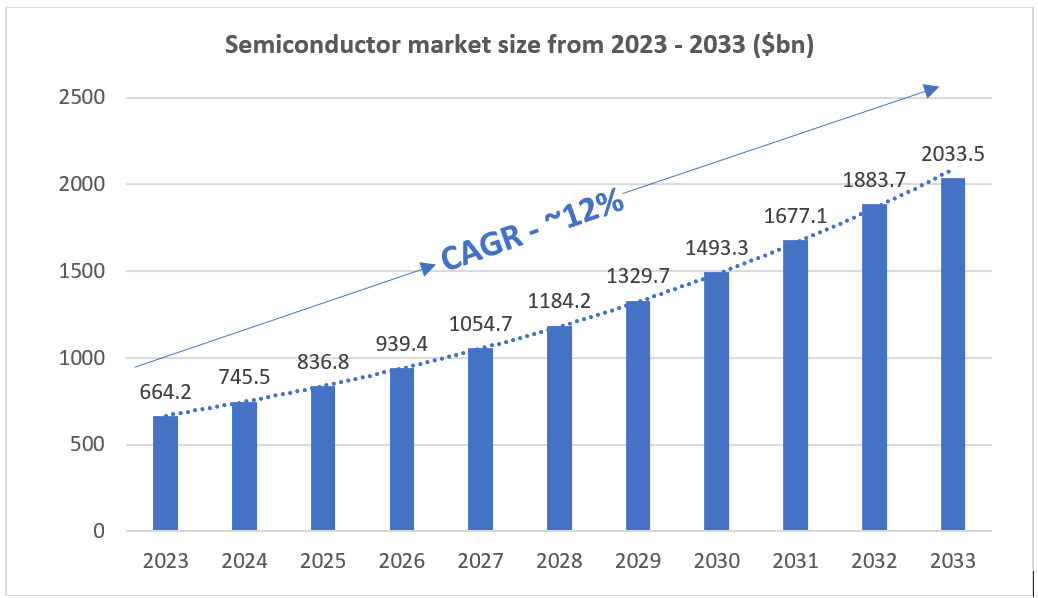

The global semiconductor market size was valued at USD 664.2 billion in 2023 and is expected to reach around USD 2,033.5 billion by 2033, poised to grow at a compound annual growth rate (CAGR) of ~11.9% during the forecast period 2024 to 2033.

Here’s an exhaustive overview of the key challenges and opportunities on the semiconductor industry’s horizon in 2024:

1. Global economic slowdown: Projections indicate a potential deceleration in the global economy in 2023, which could spell reduced demand for semiconductors.

2. Persistent supply chain disruptions: The semiconductor supply chain is an intricate, global network, making it highly susceptible to disruptions that can aggravate ongoing semiconductor shortages.

3. Geopolitical tensions: Geopolitical complexities, epitomized by the ongoing US-China trade tensions, may continue to cast a shadow over the semiconductor industry.

4. Rising costs: The cost of semiconductor manufacturing has been climbing due to factors like increasingly complex chip designs and escalating raw material prices.

5. Talent shortage: A dearth of skilled workers in areas like chip design and manufacturing is creating a talent shortage in the semiconductor industry.

1. Emerging markets poised for growth: Emerging markets, particularly China and India, appear poised to experience burgeoning demand for semiconductors.

2. New technological frontiers: The advent of novel technologies, including artificial intelligence (AI), 5G, and the Internet of Things (IoT), is projected to fuel increased demand for semiconductors.

3. Government backing: Governments worldwide are injecting investments into the semiconductor industry, driven by the objectives of bolstering economic growth and fortifying national security.

4. Industry consolidation: The semiconductor sector is undergoing consolidation, with a few major players taking the lead. This consolidation could result in heightened efficiency and innovation.

The outlook for the semiconductor industry in 2024 presents a complex tapestry of challenges and opportunities. On one hand, the industry grapples with headwinds like the anticipated global economic slowdown and persistent supply chain disruptions. On the other hand, it stands to gain from the surging demand in emerging markets and the proliferation of novel technologies.

Overall, the semiconductor industry is anticipated to retain its resilience in 2024. Nevertheless, industry stakeholders must remain vigilant, and attuned to the dynamic interplay of challenges and prospects.

1. Focus on emerging markets: Companies can strategically expand their foothold in emerging markets like China and India, where semiconductors are anticipated to witness rapid demand growth. This may entail bolstering sales and marketing efforts and tailoring products and services to meet the unique needs of these markets.

2. Invest in new technologies: Companies can channel investments into the development of cutting-edge technologies like AI, 5G, and IoT, which are expected to drive the demand for semiconductors. This could involve the creation of optimized chip designs catering to the requirements of these emerging technologies.

3. Strengthen governmental ties: Collaborative partnerships with governments can help secure support for investments and ensure access to the necessary resources for growth.

4. Embrace Cross collaboration: Collaborative endeavors within the semiconductor industry can foster innovation, reduce costs, and pave the way for novel products and services. Nvidia and TCS are collaborating to develop new AI solutions for the enterprise market. Nvidia is providing its AI hardware and software, while TCS is providing its IT services expertise. This collaboration will help to make AI more accessible and affordable for businesses of all sizes.

Nvidia and Infosys are also collaborating to develop new cloud computing solutions. Nvidia is providing its GPU hardware, while Infosys is providing its cloud computing expertise. This collaboration will help to make cloud computing more powerful and efficient for businesses.

Cross-collaborations such as these are becoming increasingly common in the tech industry. This is because technology is becoming increasingly complex and interconnected, and companies need to work together to develop innovative solutions.

By embracing these strategies, companies in the semiconductor industry can align themselves for success in 2024 and beyond.

The semiconductor industry is undeniably pivotal to the global economy, poised for ongoing growth in 2024. Nonetheless, it grapples with a gamut of challenges, such as the looming global economic slowdown and persisting supply chain disruptions. It is of paramount importance that industry players remain well-informed about these challenges and devise strategies to navigate them adeptly. Those who adeptly capitalize on the opportunities in the industry, including the growth in emerging markets and the advent of new technologies, are poised for success in 2024 and beyond.

–Deepkumar Shah (Crispidea analyst)

For more information Click here

Follow our LinkedIn page for more updates.