Overview

The gaming market size is expected to be valued at $250.45bn in 2023, displaying a projected compound annual growth rate (CAGR) of 10.1% during 2023-2030. Several key factors are driving this growth.

The widespread adoption of smartphones and the rapid advancement of 5G technology is expected to have a positive impact on the gaming market’s expansion. This increased accessibility and improved connectivity enable more people to engage in gaming, leading to a surge in demand and subsequent market growth.

Furthermore, the gaming market is benefiting from growing investments in cloud gaming. These investments facilitate the development of cloud-based gaming platforms, which allow users to stream and play games without the need for expensive hardware. This convenience attracts a larger consumer base, driving the market forward.

The rising popularity of games like Dota 2, Counter-Strike, Fortnite, @League of Legends, and PUBG Corporation, which are frequently featured in major esports events, is another contributing factor to the growth of the gaming market. These events garner substantial viewership worldwide, resulting in increased sales of games and gaming hardware as fans seek to replicate the experiences they witness.

Gaming Types

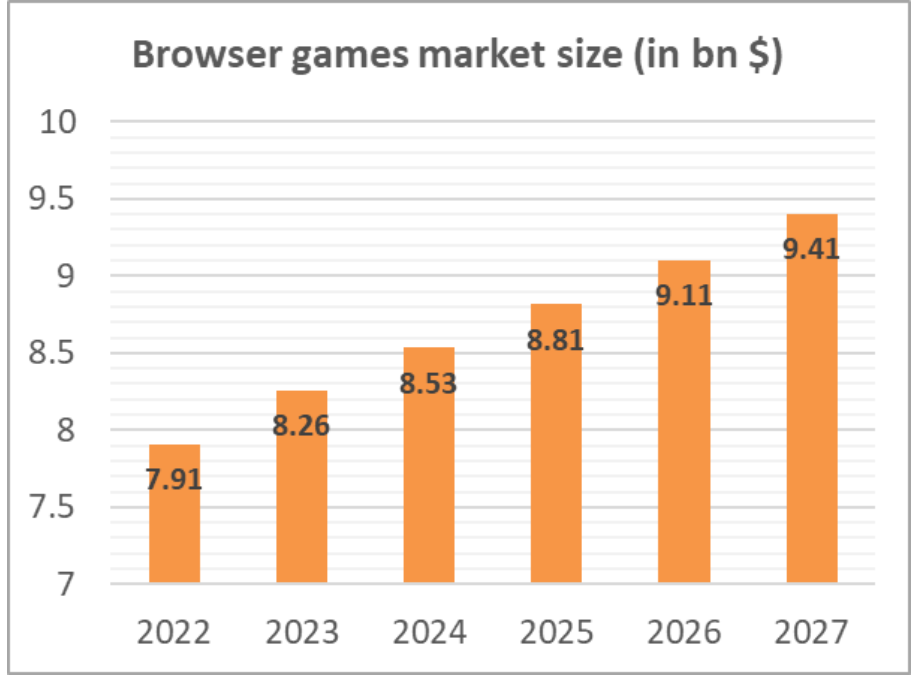

Browser games:

Asia-Pacific was the largest region in the browser games market in 2022. North America was the second largest region in the global browser games market.

Popular Browser games in 2023 are Hero Wars, Minecraft Classic, OpenArena Live, Spelunky, Eternal Fury: Resurrected, Survivor Legacy, Townscaper

Mobile games

Mobile gaming refers to the development and playing of games on devices like smartphones, feature phones, and tablets. These games can range from basic to advanced, incorporating 3D graphics, augmented reality (AR), and other features. They utilize the internet to facilitate brainstorming and collaboration among players.

In 2022, the Global Mobile gaming market size was $118bn and it is expected to reach $138.3bn in 2023, and is expected to grow to $267.46bn in 2027 at a CAGR of 17.9%.

PC games

The Global PC Games Market is valued at USD 29.35bn in the year 2022 and is expected to reach a value of USD 32.29bn by the year 2028. The global market is forecasted to grow exhibiting a AGR of 1.20% over the forecast period. PC gaming growth is projected to remain slow in comparison to mobile games due to consumer uptake of console gaming.

According to Newzoo, In February 2023, the top PC games in the world by monthly active users were Minecraft, Call of Duty: Modern Warfare II/Warzone 2.0, The Sims 4, and Roblox. Minecraft claimed the First spot as the most popular game in the world on desktop and laptop in November, taking the lead from Roblox.

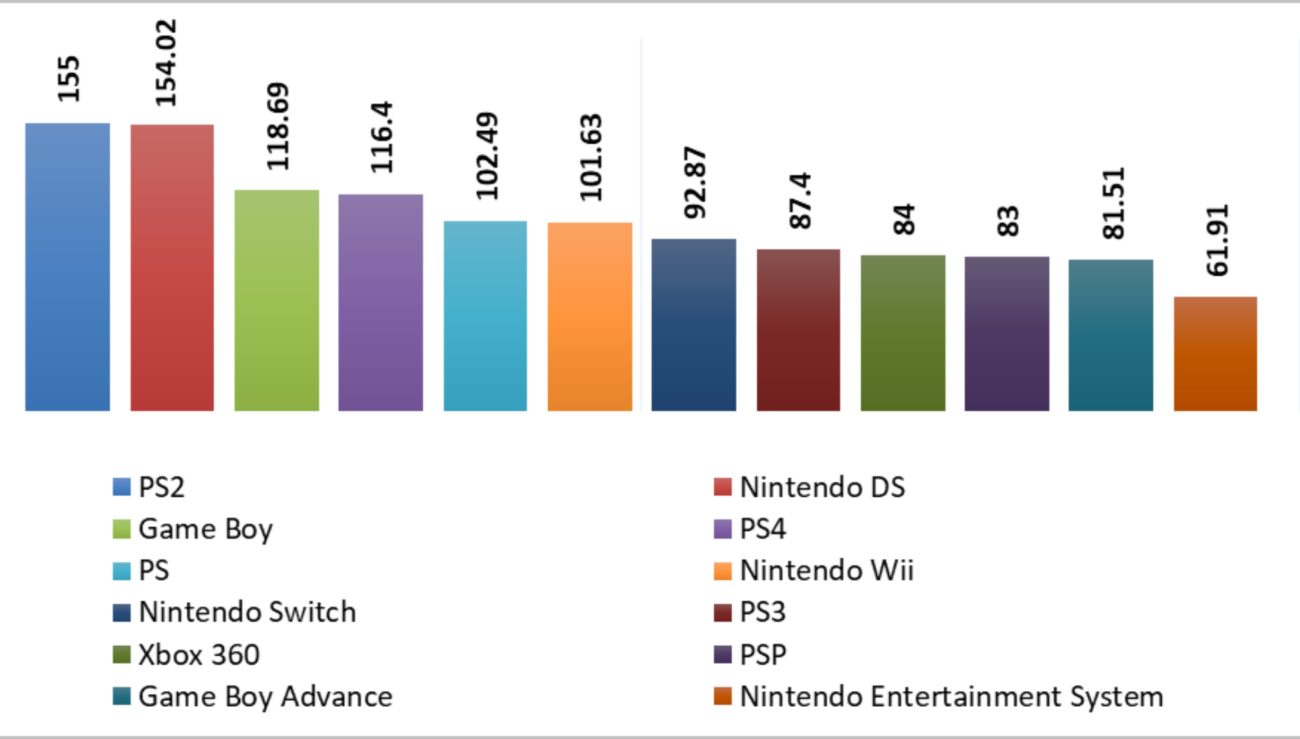

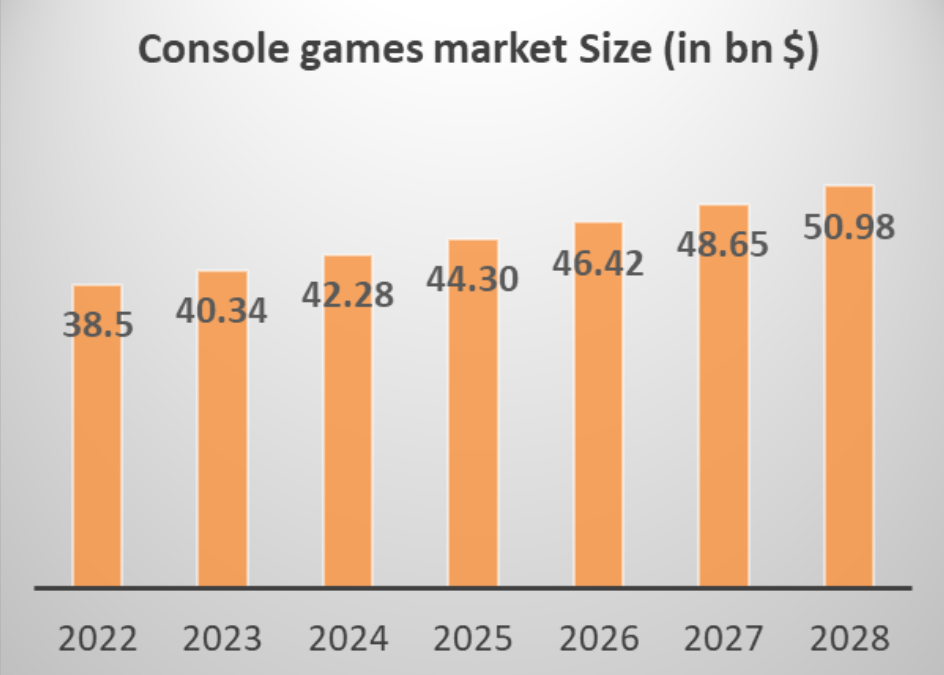

Console games/Video games

The global gaming console market size reached US$ 38.5bn in 2022. Looking forward, it is expected that the market will reach US$ ~51bn by 2028, exhibiting a growth rate (CAGR) of 4.9% during 2023-2028. The rising adoption of multi-functional gaming consoles represents one of the key factors stimulating the growth of the market. Moreover, there is a considerable increase in the utilization of the internet of things (IoT) in the gaming industry, which allows real-life interaction with the gaming world through different devices. Besides this, games are being made more user-friendly and versatile in terms of categories and graphics. This, coupled with the availability of numerous high-quality games, is positively influencing the market.

The Future of Gaming Industry

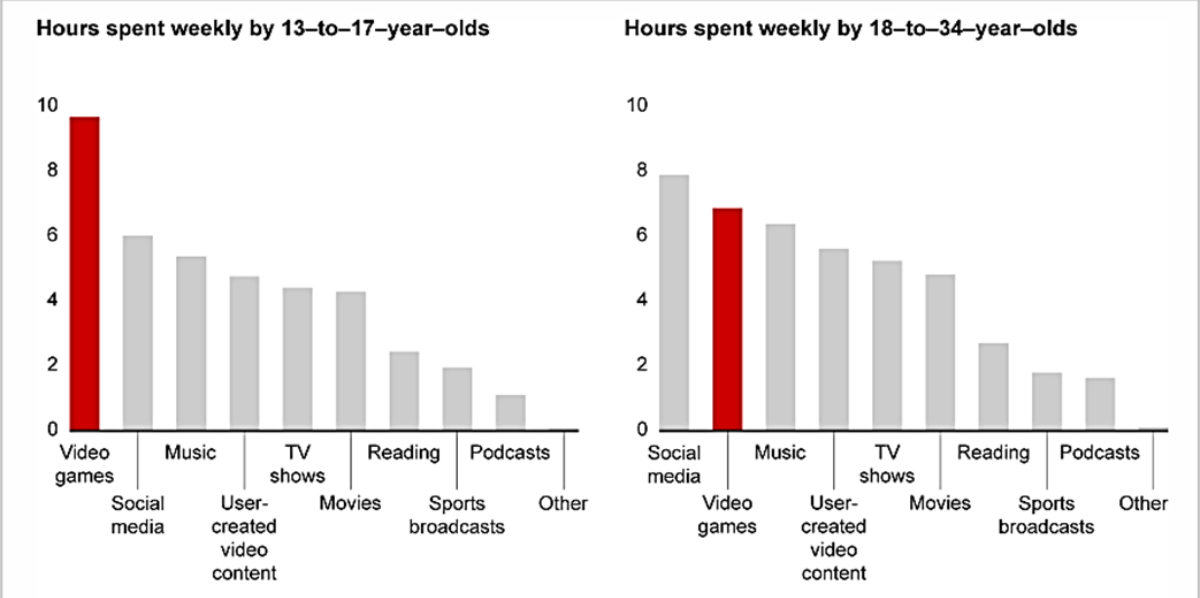

Furthermore, the gaming industry’s growth is also being accelerated by heavy engagement of younger games (ages 13 to 17) who spend about 40% more time in video game environments than with nay other form of media, including social, music, and TV.

Compared with slightly older games (18 to 34 years), younger gamers expect to spend and more time in virtual worlds, more time with augmented and virtual reality games and more time watching eSports.

Furthermore, the mobile games market generated $92.2bn in 2022, down -6.4% year on year. Spending on mobile games was slowed down by the abolition of IDFA and pressure on people’s disposable cash. Additionally, spending was still rather strong in the Q1FY22. However, it declined dramatically from the previous quarter in the second, and early indications suggest that it did not rebound in the third.

In 2022, the market for console games produced $51.8bn, a -4.2% Y/Y. Given that there won’t be many new consoles released in 2022, the console market is enjoying a sluggish year. Console gaming is more hit-driven than other market categories, hence the absence of AAA releases harms sales. Even if several recent blockbusters have been released (such as God of War Ragnarok and Call of Duty Modern Warfare II), we do not anticipate that these successes will be enough to make up for the year’s first half’s loss.

For a full analysis of the gaming industry CLICK HERE

For any query CONTACT US