Digital payments offer various benefits to governments, individuals, and businesses, including cost savings, transparency, security, convenience, and financial inclusion. It also eliminates physical barriers associated with global payments such as currency exchange, transfer rates, and security concerns.

The global digital payment market was valued at $96.19bn in 2022 and is projected to grow at a CAGR of 20.8% from 2023 to 2030. The transaction value in the digital payments market increased significantly to $8.35tn in 2022 from $7.48tn in 2021. As per CrispIdea analysis, the global digital payments market will have a transaction value of ~$9.46tn by 2023. Also, the global digital payments market is predicted to increase to $111.11bn in 2023, growing at a compound annual growth rate (CAGR) of 15.5%.

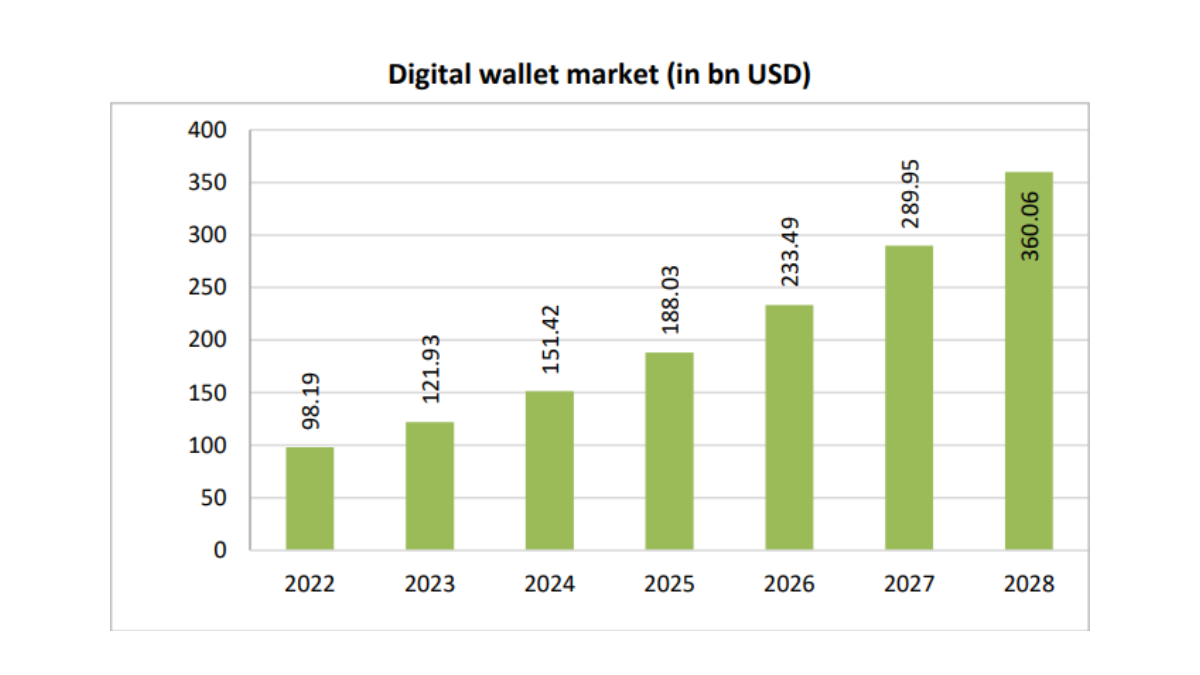

The mobile wallet sector is among the world’s fastest growing, with a value of around $98.19bn for FY22 and expected to rise to over $360bn by 2028. Fintech firms like Venmo, MoneyLion, Block, M1 Finance, and Revolut are leading the way in shaping the digital wallet’s future by providing user-friendly, mobile-optimized platforms.

The top 7 players of this industry are Square, Inc., Fiserv, Inc., PayPal Holdings, Inc., Visa Inc., MasterCard Incorporated, Apple Pay Inc. and One97 Communications Limited (PAYTM).

The total transaction value in the digital payments segment is projected to reach around $14.78tn by 2027, up from $7.48tn in 2021, according to data from Statista. This represents a significant growth in the digital payments market and highlights the increasing adoption of digital payment methods by consumers and businesses alike.

The market’s largest segment is digital commerce, with a projected total transaction value of $6.03tn in 2023. This includes online shopping and other forms of e-commerce, which have seen a surge in popularity in recent years.

The mPOS system segment was valued at $3.30tn in 2023 and is expected to reach $5.58tn by 2027. mPOS systems allow merchants to accept payments using mobile devices, making it easier for small businesses and entrepreneurs to accept digital payments. Whereas the digital remittances segment is estimated to reach $174.50mn by 2027 from $135.20mn in 2023.

-Deepkumar Shah (CrispIdea Analyst)

DOWNLOAD OUR FULL REPORT NOW!!!!!